Table Of Content

Conventional loans, also known as conforming loans, aren’t backed by the government. You typically need a minimum credit score of 620 to qualify for a conventional mortgage. On the other hand, FHA loans don't need a higher score and are insured by the Federal Housing Administration, making it easier to qualify as a homeowner with lower credit scores. For example, you can be eligible for an FHA mortgage with a minimum credit score of 580.

Average mortgage balance among Credit Karma members:

The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. The information is accurate as of the publish date, but always check the provider’s website for the most current information. Victoria Araj is a Section Editor for Rocket Mortgage and held roles in mortgage banking, public relations and more in her 15+ years with the company. Considering the example above, if you take out a $110,000 loan and put $40,000 down ($10,000 more than before), your LTV is now 0.73, or 73%.

I Own My House Outright and Want a Loan: Is It Possible? 2024 - The Mortgage Reports

I Own My House Outright and Want a Loan: Is It Possible? 2024.

Posted: Thu, 01 Feb 2024 08:00:00 GMT [source]

Credit cards

Rocket Mortgage® makes it easy to get a mortgage — you just tell the company about yourself, your home, your finances and Rocket Mortgage® gives you real interest rates and numbers. You can use Rocket Mortgage® to get approved, ask questions about your mortgage, manage your payments and more. The amount of money you owe makes up another 30 percent of your FICO score. If you have high credit card or loan balances, a lender may hesitate to lend you additional funds. For homebuyers, it is crucial to consistently work on improving your credit score.

Estimated monthly payment

Some lenders will let you buy a home with a 620 credit score, and others may require a higher minimum credit score. Although there are both FICO and VantageScore credit scores, you’ll likely want to check your FICO score, as lenders refer to this score most. Even though you might have to pay a small fee, getting your score directly from myFICO is the most accurate way to check it. In addition, some credit card issuers offer free access to credit scores. Note that the minimum scores listed above are for FICO credit scores, specifically — this is the scoring model mortgage lenders typically turn to when considering applications.

Your payment history is a big part of your credit score, so making sure you pay those recurring small bills on time is very helpful to establish a strong payment history. A credit score is a number that tells the creditworthiness of an individual. It is based on the credit history and financial behavior of a person. When it comes to home buying, the credit score needed to buy a house greatly influences mortgage eligibility. These large home loans exceed conforming limits set by Freddie Mac and Fannie Mae.

Check your credit

The USDA doesn’t set a minimum credit score, but most lenders require at least 640. The minimum credit score you’ll need to purchase a home varies by lender as well as the type of mortgage you’re seeking. When you apply, the lender will usually check your FICO score from the three credit bureaus to see if you qualify. Conventional lenders now require a 780 credit score or higher to qualify for the lowest mortgage interest rates, so anything above 780 is considered an excellent score to buy a house. Armed with this score, you can secure a more affordable monthly payment and have more buying power when making purchase offers. Lenders often reward high credit score borrowers with fewer documentation requirements, a smoother approval process and exceptions for high DTI ratios.

Buying Options

You could still secure a decent mortgage with a score of 680 or 690—depending on the lender. Here's what minimum credit score is needed to buy a house, where to get your credit score and ways to improve your credit score quickly and efficiently. Among Credit Karma members with mortgages, baby boomers has the highest average credit score at 724. Older generations tend to have higher credit scores, likely because they’ve had more time to work on their credit. There are some steps that may help improve your odds of buying a house with low credit scores. You can get approved with more total debtLenders measure your DTI ratio by dividing your total debt by your gross income.

How much down payment do I need for a...

If you have a strong credit score, you'll have a better chance of securing a good mortgage rate. While you generally need decent credit to get approved for a conventional loan, government-backed loans can be more accessible to borrowers with bad credit. If a lender seems optimal to you, preapproval is your next step.

No down payment is required and, while most lenders will want a 620, the VA doesn't set any credit score requirements. Your mortgage lender will first look at the type of loan you are applying for to determine the minimum credit score to qualify as well as your down payment amount. For example, on a $300,000 mortgage, the difference in principal and interest payments between a 7 percent interest rate and a 6.5 percent rate is $99 per month. That comes out to more than $35,000 over the course of a 30-year mortgage term. You can get Veterans Affairs (VA)-backed refinancing with a credit score as low as 500 from some lenders.

What credit scores do you need for a mortgage? - CNN Underscored

What credit scores do you need for a mortgage?.

Posted: Tue, 30 Jan 2024 08:00:00 GMT [source]

With nearly two decades in journalism, Dori Zinn has covered loans and other personal finance topics for the better part of her career. She loves helping people learn about money, whether that’s preparing for retirement, saving for college, crafting a budget or starting to invest. Her work has been featured in the New York Times, Wall Street Journal, CNN, Yahoo, TIME, AP, CNET, New York Post and more. “Expert verified” means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity.

If you’re in the market for a jumbo loan (loans that are for larger amounts), you will likely need a credit score of 680 or higher. This is to account for the larger risk that the lender takes with larger loans. There are a few other loan programs that have lower credit score requirements – we’ll investigate those in more depth in the next section.

Rocket Homes Real Estate LLC is committed to ensuring digital accessibility for individuals with disabilities. We are continuously working to improve the accessibility of our web experience for everyone, and we welcome feedback and accommodation requests. If you wish to report an issue or seek an accommodation, please contact us at If your credit isn’t ideal and you want to improve it before you buy a house, there are several things you can do. A Department of Veterans’ Affairs (VA) home loan may be available to you if you’ve served in the armed forces for at least 24 months. You may be eligible if you’re currently active duty, or if you received an honorable discharge upon leaving the military.

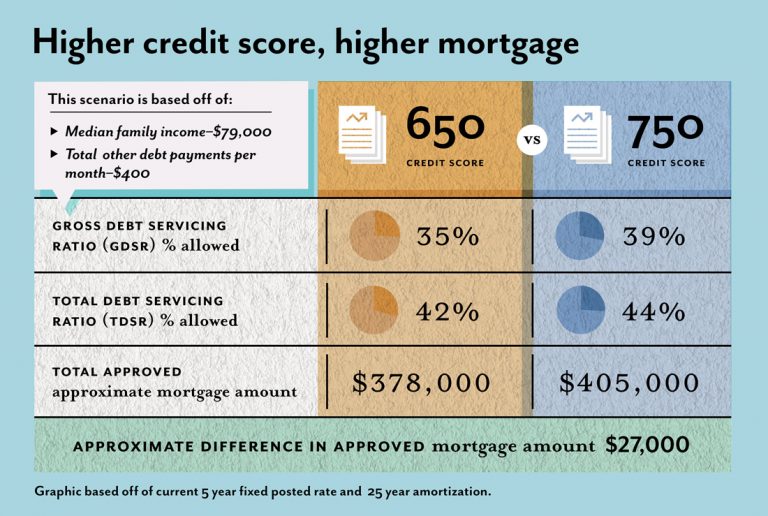

A 650 credit score makes you eligible for most types of home loans, including conventional, FHA, VA and USDA loans. Still, this score falls within the top of the fair credit score range, which means you’ll likely qualify for higher interest rates, resulting in a pricier monthly payment. The less debt you have, the easier you will be able to buy a house sooner since lenders consider you less risky. You can divide the number of your debts by your monthly income to calculate your DTI.

However, some lenders may have an internal policy requiring a minimum 620 score. It’s best to shop around and compare offers from different lenders. On the other hand, the minimum credit score varies from one mortgage type you want to the next.

If you want to qualify for a loan and your credit score isn’t up to par, you can take actionable steps to improve your credit score. Let’s walk through some of the ways to increase your score before buying a house. Typically, you'll need a credit score of 620 if you want to take out a mortgage. Either way, you'll want to spend some time boosting your credit score before you apply for a mortgage to get the most favorable rate.

Most jumbo loan programs require a credit score of at least 700, although there may be programs with lower score limits if you can afford a higher interest rate and payment. Before applying for a loan, though, you’ll want to take a look at your credit report and clear up any outstanding negative marks. The time and money you put into raising your credit score before you apply for a mortgage will save you money over the course of your loan.

No comments:

Post a Comment